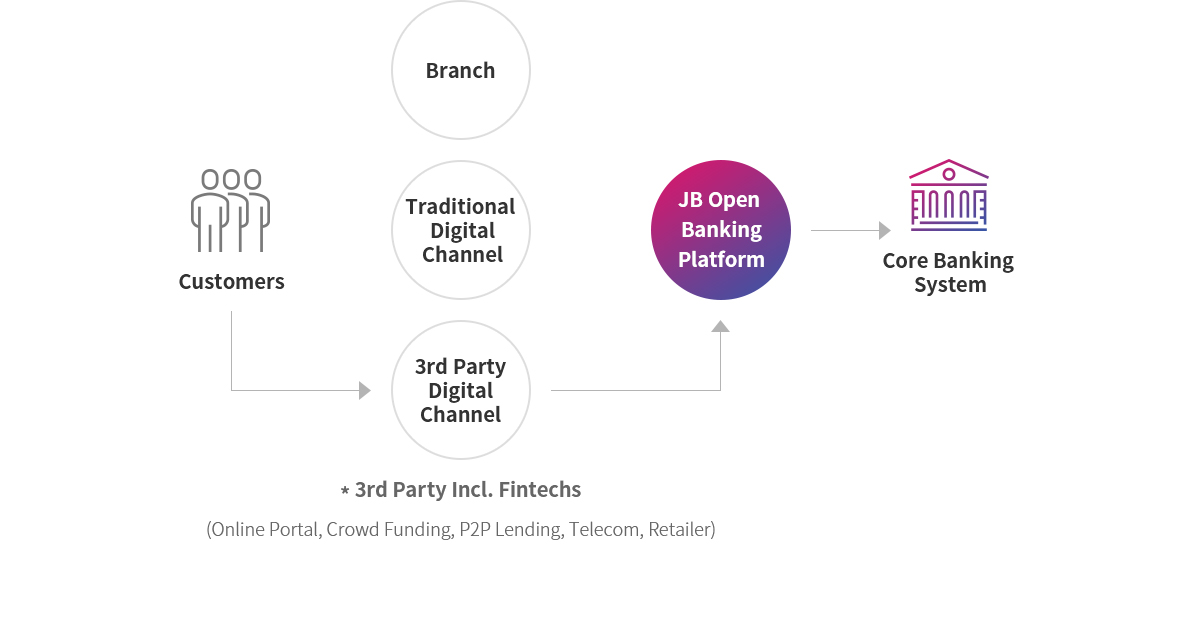

JB Open Banking Platform developed by JB Financial Group not only facilitates banks to easily collaborate with 3rd Party, but also can help accelerate digitalisation of banking business by effectively using oter open APIs from outside and modulising existing banking processes accordingly.

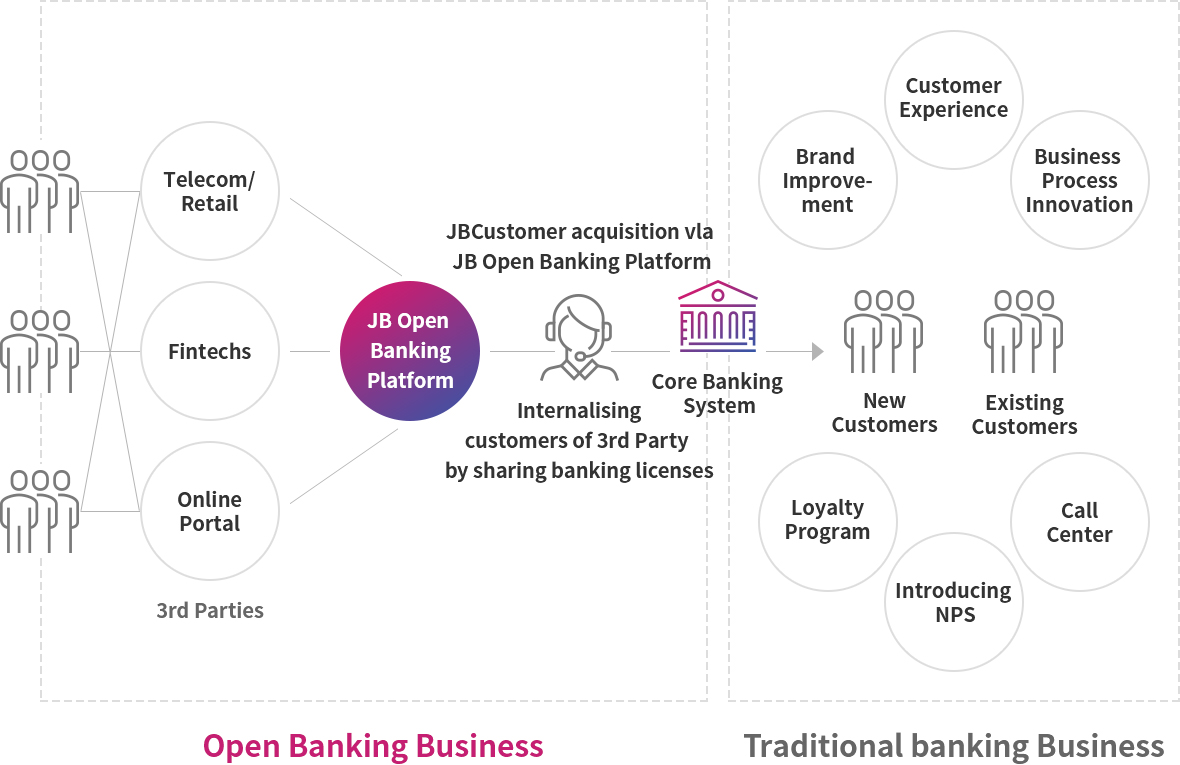

Unlike other open API platform providers such as BBVA, CITI and Credit Agricole aiming to provide API marketplace to 3rd Parties, JB Open Banking Platform provides a set of APIs of bespoke banking services for 3rd Parties to be able to use banking services functions without hassles. Global experts, therefore, evaluate that JB Open Banking Platform is differentiated from other platform providers in that a bank provides its banking products and services by sharing its banking license.

Digitization of

Banking

We digitize the banking business

by modularizing existing businesses in API form.

API

packaging

We packaged API for partners

to easily provide financial services.

Sharing

financial license

We provide banking services

by sharing financial licenses with partners

Key Benefits

Utilising 3rd Parties to act as a bank’s digital branch

A bank with JB Open Banking Platform will be able to utilise 3rd Parties to act as a bank’s digital branch along with its current internet and mobile banking channel. By utilising 3rd Party as a digital branch of the bank, JBFG’s new approach will take effect of making the bank expand its digital customer contact points.

As such, a bank will be able to acquire new customers from 3rd parties connecting to core banking system of the bank through the Platform. The bank implementing JB Open Banking Platform in its core banking system will be able to increase diverse types of fee revenues by providing banking services to 3rd parties.

Everywhere Banking

Bank has been jeopardised managing its customer contact points caused by societal digitalisation through internet and mobile, because customers continue to move into 3rd parties such as Fintechs, retailers and SNS which have closer channels than banks. Given that financial services are usually in the last step in order for customers to fulfill their needs, it may be natural that banks continue to lose their influence toward customers. In order to overcome the negative trend towards banking industry, it is inevitable that a bank needs to approach customer contact points closer by helping 3rd parties provide banking products and services in the form of digital agent banking services.

Most banks have traditionally been strong to retain customers ? 7 out of 10 new customers continue to remain bank’s customers permanently. Banks, therefore, will be able to make every effort on bank’s core capabilities such as product development, risk management and regulatory adaption, if 3rd parties share bank’s burden acquiring new customers.

JB Open Banking Platform will allow banks to significantly increase cross-sell opportunities for their new customers acquired from 3rd parties whilst 3rd parties can also increase opportunities to sell its goods and services by immediately providing banking services to their customers. Agent banking services mean providing limited scale banking and financial services to the underserved population through engaged agents under a valid agency agreement.

Comprehensive Digital Transformation

t is common that banks only focus on changing existing businesses into digital ones for their digital transformation. It, however, is highly likely to be fragmented digitalisation of the whole banking business.

In our point of view, every part in the entire value chain should be digitalised in order to achieve the comprehensive digitalisation of the banking business. In order to consolidate banking services capabilities, especially front-end channels, JB Open Banking Platform needs to be accompanied in a digital world.

JB Open Banking Platform is an innovative platform being able to achieve comprehensive digital transformation by digitalising both bank's traditional businesses and bank’s front-end businesses with the 3rd parties’ digital channel.

The Introduction of O-Bank

JB Financial Group is expanding its innovative financial services not only in South Korea, but also in Southeast Asia with JB Open Banking Platform (OBP; further shall be referred to as “OBP”) enabling 3rd Parties to leverage banking services for their businesses. O-Bank is a new brand name for financial products and services provided by the Platform.

Creating

a FinTech

ecosystem

Leap into

a leading FinTech

financial company

Shared growth

with partners

Transformation of Business Models in Banking Industry

In order to attract millennials (born between 1980s and 2000s) as also known as digital natives who are familiar with mobile and social media, most banks have initiated to transform their business models. For instance, internet primary bank has been a well-known business model, and new types of financial services combining with non-traditional banking technologies such as simple mobile payment, P2P lending, and crowd funding have been introduced. Partnerships between banks and Fintechs have become inevitable in order to create banking contents efficiently, which drives to appear a new business model, BaaP (Banking as a Platform) in financial industry.

JB Financial Group’s Efforts To Adapt To New Environment

JB Financial Group has put lots of efforts to cope with an era of digital disruption. JB Financial Group took account of introducing Open Bank business model of the Group for its digital transformation, Open Banking Platform allowing 3rd Parties to act as a bank’s digital branches. In order to attest the model, JB Financial Group has constantly held Fintech competition and global hackathon not only to incubate Fintech startups, but also to deploy innovative IT technologies. As a result of the efforts, JB Financial Group has successfully got to commercialise OBP. The platform implemented into Kwangju Bank in South Korea and one of partner banks in Cambodia. Both have been operating well and creating several competitive business cases without any technical issues.

JB Financial Group will continuously help Fintechs and banks to collaborate with each other seamlessly by providing our valuable know-how and expertise from its experience.

Definition of BaaP

BaaP, Banking-as-a-Platform, allows 3rd parties to provide financial services to customers by utilising financial APIs that banks create. In the platform, banks are responsible for not only offering 3rd parties business opportunities abided by financial regulations to develop innovative financial products, but also managing IT environments and releasing new services in a timely manner. It becomes plausible to share private information between financial institutions and 3rd parties in BaaP under customers’ consents, and will eventually maximise user experience since consumers would be able to access to various financial services designed based on their own information.

The benefits of BaaP

Openness & Connectivity

Sharing financial information with 3rd parties enhances the value of information. Banks can also leverage BaaP to expand their sales channels and reach prospective customers since it acts as a hub to connect 3rd parties and their customers.

Module

BaaP consisting of module-based framework allows 3rd parties to provide financial services merely by deploying preferable business modules into their existing system.

Open API

Open API is an essential component that enables both banks and 3rd parties to integrate BaaP with their legacy systems rapidly. By utilizing open APIs in BaaP, 3rd parties can customise their services easily when collaborating with financial partners.