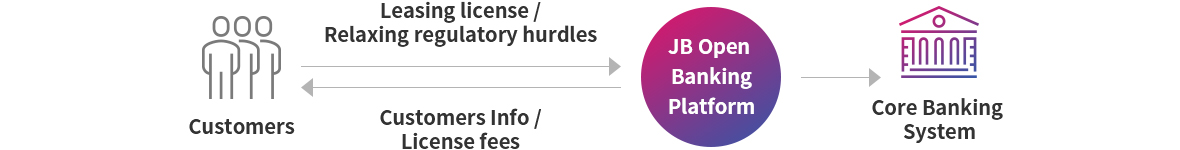

P2P Model

Background

Like other regions, P2P Fintech needs regulations to meet to keep its business in South Korea which are related to KYC and AML, IT security,

and customer privacy in the same level that banks already fulfill. JB Financial Group made a partnership with a P2P Fintech, which allowed the Fintech to provide its financial services to its customers without any regulatory barrier.

How to work

JB OBP suggested a new P2P business model that Fintech and a bank can collaborate with each other. P2P Fintech transfers investor’s amounts to bank after it matches amounts of between investment and lending. As such, investors will be able to be protected by bank for their investment amounts in a case that P2P goes in bankruptcy and shutdown not related to their investment decision.

Bank can also help P2P meet strict regulations such as KYC, AML, customer privacy, IT requirements etc. Bank can earn fees as well as get new customers from P2P. Our partner bank is able to acquire a significant number of customers from P2P, a 2% of total active customers of the bank within the first year.

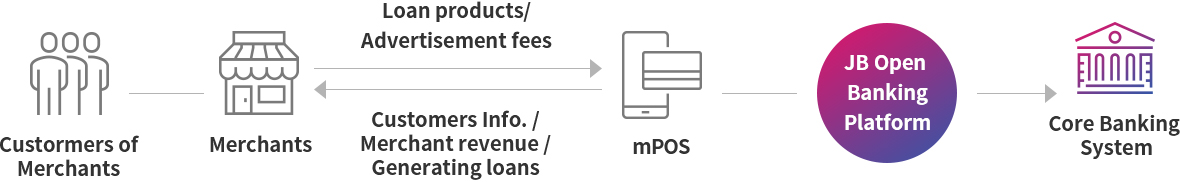

mPOS

Background

A Fintech providing mPOS terminal to merchants that sell luxury goods is searching for a new business model being able to capitalise information created by mPOS transactions. The company intends to provide lending services not only to merchants but also to their customers, based on merchants’ sale information.

How to work

JB OBP analyses the sales result and personal credit information sent by mPOS. Our partner bank offers financial products and services to merchants as well as customers using the merchants, based on merchants’ sales information.

Our partner bank estimates that it will acquire 40K customers and make profits around c.USD1m during the first year of the service.

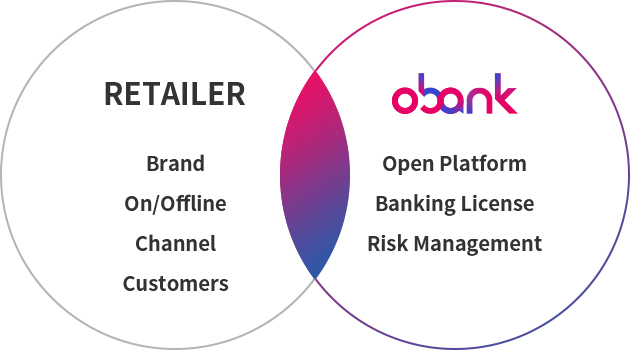

Retail Group

Background

Our retail partner is one of the largest retail companies in South Korea that serves over 6 million customers. Our retail partner is eager to provide financial services to its customers on the purpose of retaining them in its digital channel. Our retail partner, however, is not able to provide banking services to them due to strict banking regulations.

How to work

JB OBP offers white-label services for our retail partner to be able to provide a variety of financial products and services. The services enable our partner retail group to keep its brand value as well as to help their sales increase by offering financial products at the point of sales. Customers only recognise the name of our retail partner even when they are using financial products whilst our partner bank acquires customer information through JB OBP.

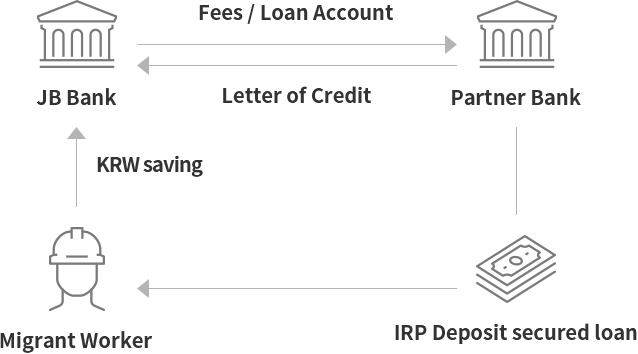

Deposit Secured Loans

Background

There are c.650K migrant workers from Southeast in South Korea. Although the workers are eager to remit their salary to their home country, high commission fees prohibit them from sending money frequently. The high commission fees are caused by current expensive lines and brokerage fees of banks.

How to work

A migrant worker makes a deposit in South Korea, which is linked with JB OBP. Our partner bank in worker’s home country lends money to worker’s account while our partner bank in South Korea collateralises the worker’s deposit. The more partner banks are using JB OBP,

the more benefits and opportunities migrant workers can enjoy.